The Dignity Fund was Elizabeth Funk’s first endeavour in the field of social impact investing. She founded it in conjunction with Maya Chorengel in 2003, long before impact investing was the impressive movement that it has become today.

Dignity Fund’s mission was to prove the concept that investors could make money while helping the poor. Yet our mission was broader than just mobilizing the millions that we raised. We also worked actively to provide a “demonstration effect” in the hopes of inspiring larger institutions and funds to follow our lead. To achieve this goal, Dignity Fund had a policy of co-investing with another institution on every investment we made. Additionally, Dignity Fund had an extensive Advisory Board of leaders from major organizations such as Deutsche Bank, Citibank, ACCION and others. We are proud that each of our Advisory Board members went on to engage in Microfinance projects of their own.

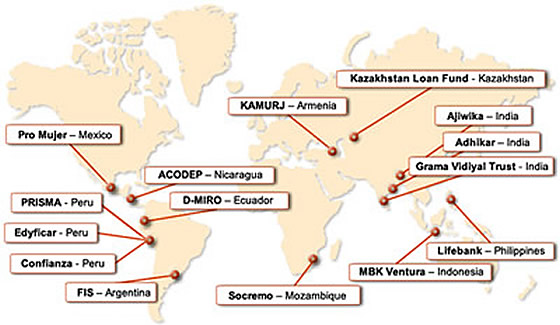

Dignity Fund raised money from US-based impact investors, and lent those funds to 15 different Microfinance Institutions (MFIs) around the world. Dignity Fund was an early innovator in structuring capital flows to the developing world. We structured loans in local currency, with innovative financial structurings to protect the MFIs from currency fluctuations.

In total, Dignity Fund invested in 15 MFIs over a 7 year period, resulting in helping many millions of borrowers bring their families out of poverty.

Profile of Microfinance Institutions funded (data as of 12/ 31/2008)

14.930 Clients | $21.923.464 Loan Portfolio | 2.3% PAR > 30 days

Socremo continues to grow th eir sa vings program with cuslomers and replace borrowings with depositaccounts. Addi tionally,th ey have paid back our guarantee in full during Ql 2009. The cost of funding from abroad became prohibitively high due to a ounitive tax rel!hne.

26,113 Clients | $3,995,424 Loan Portfolio | 3.5% PAR > 30 days

Pro Mujer Mexico experienced an increase in PAR in 2008 due to a change in how it computes this ratio (it now reports more conservatively) . PAR aside, the MFl’s financial and operating statistics are strong. That being said, disappointed with the lack of strong growth by the MFl , Pro Mujer lnternational, PMM’s governing institution, replaced PMM ‘s CEO and Board of Directors of the MFl. The new team is strong and Is positioning the MFI for more aggressive growth.

105,364 Clients | $5,206,746 Loan Portfolio | 0.0% PAR > 30 days

Unrealized foreign exchange losses have impacted MBK’s balance sheet. Management and lenders are actively working to address the Issue. Otherwise, MBK is doing fine operationally.

59,633 Clients | $86,280,520 Loan Portfolio | 4.2% PAR > 30 days

The number of active borrowers grew 24% and the loan portfolio 40% during the year. They have strengthened their shareholder base and reduced leverage to 6x.

36,174 Clients | $23,976,832 Loan Portfolio | 2.5% PAR > 30 days

The number of active borrowers grew 75% and the loan portfolio 72% during the year. D-Miro has not had difficulty obtaining funding from international sources but is planning on becoming a regulated entity that accepts deposits in order to reduce its dependency on foreign debt.

3,776 Clients | $2,905,257 Loan Portfolio | 8.3% PAR > 30 days

The local impact of the current economic situation has been difficult and a significant number of repeat customers are experiencing problems. Management has acted quickly and aggressively to help their clients restructure loans in a variety of ways.

12,826 Clients | $1,302,493 Loan Portfolio | 14% PAR > 30 days

Ajiwika experienced significant delinquency and related risk ro their loan portfolio due to poor targeting and inadequate internal controls. Our partner, Unitus and other agencies have been working diligently over the past several months to determine the root causes and ensure systems are in place to prevent recurrence.

53,595 Clients | $4,892,073 Loan Portfolio | 0.3% PAR > 30 days

They have experienced good growth of 22%, bur which falls short of their projections. This is due to the current economic situation and Adhikar’s difficulty in raising debt.

13,361 Clients | $10,935,732 Loan Portfolio | 0.4% PAR > 30 days

Kamurj’s financial performance remains solid. Its portfolio quality is outstanding. it has very little external debt and a strong capital base, and it remains very profitably. The MFl’s borrower and loan growth has been modest, with an increase in borrowers of only approximately 30% in the two years since we first extended a facility.

47,211 Clients | $21,942,421 Loan Portfolio | 16.2% PAR > 30 days

During the year, an $800,000 Fraud was encountered, the CEO/Chairman was replaced and other changes at the leadership level were made. Management has taken corrective action and put additional controls in place. Lenders are actively monitoring. All principal and interest payments have been made as scheduled.

207,545 Clients | $19,296,801 Loan Portfolio | 0.5% PAR > 30 days

Lifebank’s performance in 2008 has been impressive with 60% growth in its loan portfolio and total assets. It has an extensive branch network with 219 offices with nearly 2,000 employees providing loans averaging US$92.